This Weekly Grain Market Review for Friday, December 23, 2022 is provided by KSU Extension Agricultural Economist Daniel O’Brien. The USDA World Agricultural Outlook Board (WAOB) released it’s latest World Agricultural Supply and Demand Estimates (WASDE) on December 9th, with the next USDA WASDE report to be released on Thursday, January 12, 2023.

I. CME Corn Futures: 12/22/2022 Closes, Spreads + 2022 Highs & Lows

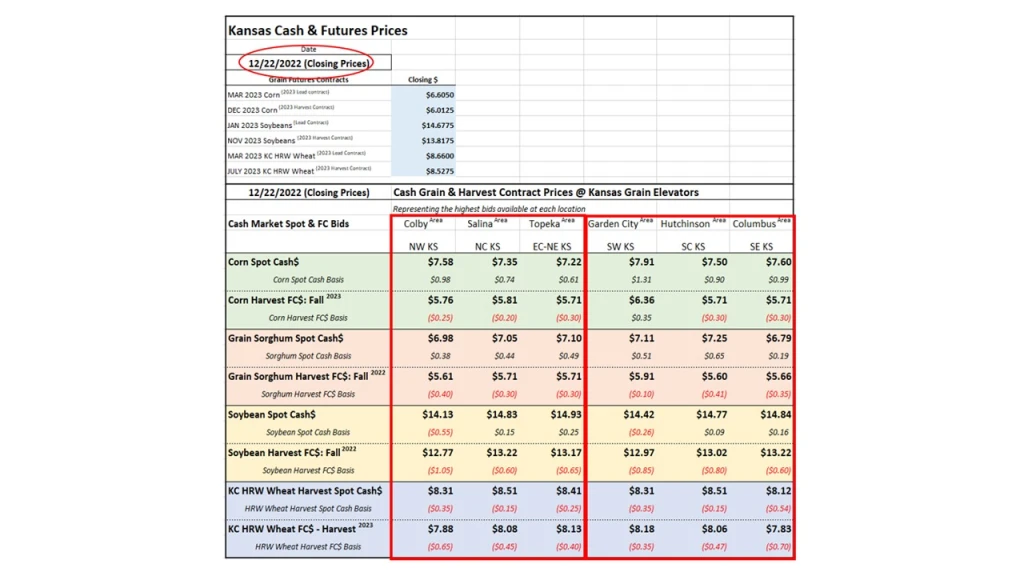

- CME Corn Futures: The current lead CME MARCH 2023 Corn futures contract closed at $6.60 1/2 per bushel on Thursday, December 22nd – down $0.0175 from the previous day. Thursday, December 22nd was the last trading day before the 2022 Christmas holiday. “New Crop” DEC’23 Corn futures closed at $6.01 1/4 – down $0.01 from the previous day. This MAR’23-DEC’23 decline of $0.59 /bu. (down 9%) shows that as of December 22, 2022 the U.S. corn trade implicitly “expects” at least a moderate improvement in U.S. and Global corn supply-demand balances, with the likelihood of lower prices occurring – all else being equal.

- Corn Futures Carry: On Thursday, December 22nd there were no positive carrying charges across CME Corn futures contracts in year 2023 – providing no incentive for farmers to store grain for later sale in 2023 (from a futures price perspective). The MAR’23-MAY’23 spread is a negative 1/4 cent – from $6.60 1/2 to $6.60 1/4 per bushel. The MAY’23-JULY’23 spread is a negative 6 cents/bu (-$0.03 /bu/mo) – providing a negative incentive for storage of cash grain from now into Spring-early Summer 2023. Then there is anticipation that the 2023 U.S. corn market will move lower into Fall 2023 likely due to a successful 2023 crop, with the JULY’23-SEPT’23 spread being negative seasonally at minuse 39 1/2 cents/bu (-$0.19 5/8 /bu/mo). Then moving into the Fall 2023 harvest, the SEPT’23-DEC’23 spread is a negative 13 3/4 cents/bu into harvest (-$0.04583 /bu/mo) – representing a conventional, traditional “fall harvest low” being expected by the market in year 2023.

- CME Corn Futures Price Action since During 2022:

- At the start of 2022, the CME MAR’22 Corn lead contract closed the week ending on January 7th at $6.06 3/4 per bushel

- Then in the midst of global grain market concerns about how the Ukraine-Russia war may impact grain markets, CME MAY’22 Corn traded as high as $8.25 1/2 per bushel before closing at $8.13 1/2 for the week ending April 29, 2022.

- Concerning the grain market impact of the Black Sea geopolitical conflict, market fears and concerns about the war’s impact was less immediate and acute during the week ending July 22, 2022. Also, eastern and central U.S. Corn Belt crop prospects became less worrisome. As a result, CME SEPT’22 Corn futures traded as low as $5.61 3/4 before closing at $5.64 1/4 per bushel for the week.

- Following the July 2022 low, corn futures prices trended higher, with CME DEC’22 Corn futures trading as high as $7.06 1/2 /bu during the week of October 14th before closing at $6.89 3/4 per bushel

- Through mid-to-late December 2022, during the week closing on December 23rd, CME MAR’23 Corn closed at $6.66 1/4 per bushel.

- The 12/23/2022 lead corn futures closing price is up $0.59 1/2 per bushel from $6.06 3/4 for MAR’2022 during the first week of January, 2022.

II. CME Soybean Futures: 12/22/2022 Closes, Spreads + 2022 Highs & Lows

- CME Soybean Futures: The current lead JANUARY 2023 CME Soybean futures contract closed at $14.67 3/4 per bushel on Thursday, December 22nd – down $0.1325 from the previous day. “New Crop” NOV’23 Soybean futures closed at $13.81 3/4 – down $0.08 3/4 the same day. Similar to the corn market, this JAN’23-NOV’23 decline of $0.86 /bu. (down 5.9%) shows that as of December 22, 2022 the U.S. soybean trade collectively “expects” at least a moderate improvement in U.S. and Global soybean supply-demand balances, with a moderate decline in soybean market prices by the end of year 2023.

- .

- Soybean Futures Carry: As of December 22nd, there were moderately positive carrying charges across CME Soybean futures contracts through early summer in year 2023 – providing some small and limited incentive to store soybeans for later sale in Spring-early 2023 from a futures price perspective. The JAN’23-MAR’23 spread is a positive 4 1/4 cents (up $0.02 1/8 /bu/mo) from prices of $14.67 3/4 to $14.72 per bushel, respectively. The MAR’23-MAY’23 spread is also a positive 3 3/4 cents/bu (+$0.01 7/8 /bu/mo.), and the MAY’23-JULY’23 spread is also a positive 2 1/4 cents/bu (+$0.01 1/4 /bu/mo.) These positive carries provide small positive incentives for storage of cash soybeans from now into Spring-early Summer 2023. Then there is anticipation that the 2023 U.S. soybean market will move lower from Summer into Fall 2023 with presumptions of successful 2023 soybean crops in the U.S. and South America, with the JULY’23-AUG’23 spread being negative seasonally by $0.19 3/4 /bu, and the AUG’23-SEPT’23 spread also sharply negative by $0.51 1/2 /bu/mo. Moving into the Fall 2023 harvest, the SEPT’23-NOV’23 spread is a negative 25 1/4 cents/bu into harvest (-$0.12 1/8 /bu/mo) – representing a conventional, traditional “fall harvest low” being expected in year 2023 (just as for corn futures).

- .

- CME Soybean Futures Price Action since During 2022:

- At the start of 2022, the CME MAR’22 Soybeans lead contract closed the week ending on January 7th at $14.10 1/4 per bushel.

- Due to issues related to the availability of the 2022 South American soybean crops to World export markets, MARCH’23 Soybean futures traded as high as $17.59 1/4 per bushel before closing at $15.84 1/2 per bushel for the week ending February 25, 2022.

- Then during the time period of global grain market concerns about how the Ukraine-Russia war may impact grain markets, CME JULY’22 Soybeans traded as high as $17.49 1/4 per bushel before closing at $16.97 3/4 for the week ending June 3, 2022 (i.e., and indirect market effect since soybeans are not a major crop grown by Ukraine. However, Ukraine sunflower oil production and exports ARE a major concern, with cross-market impacts in the oilseed crop and co-product complex).

- As concerns about the grain market impact of the Black Sea geopolitical conflict at least moderately diminished, and Eastern and Central Corn Belt crop prospects became less worrisome, CME AUGUST’22 Soybean futures traded as low as $12.88 1/2 before closing at $13.15 3/4 per bushel for the week ending July 22, 2022.

- Following the July 2022 soybean market low, soybean futures prices trended higher, with CME NOV’22 Soybean futures trading as high as $15.08 3/4 /bu. during the week of September 16th before closing at $14.48 1/2 per bushel

- Through mid-to-late December 2022, CME JAN’23 Soybeans traded as high as $14.92 3/4 per bushel for the week ending December 9th, while closing at $14.84 1/2 per bushel during the week ending December 23rd.

- The 12/23/2022 lead soybean futures closing price of $14.84 1/2 is up $0.74 1/4 per bushel from $14.10 1/4 for CME MAR’2022 Soybeans during the first week of January, 2022.

III. CME HRW Wheat Futures: 12/22/2022 Closes, Spreads + 2022 Highs & Lows

- CME HRW Wheat Futures: The current lead MARCH 2023 CME Hard Red Winter (HRW) Wheat futures contract closed at $8.66 per bushel on Thursday, December 22nd – down $0.03 1/4 from the previous day. “New Crop” JULY’23 HRW Wheat futures closed at $8.52 3/4 – in turn up $0.03 1/2 per bushel from the previous day. This MAR’23-JULY’23 decline of $0.13 1/4 per bushel (down 1.5%) indicates that as of December 22, 2022 the U.S. & global wheat trade implicitly “expects” little if any change in U.S. and Global soybean supply-demand balances in 2023.

- .

- HRW Wheat Futures Carry: As of December 22nd, there were no positive carrying charges across CME Kansas HRW Wheat futures contracts through the 2023 Summer harvest – providing no incentive to store grain for later sale in 2023 from a futures price perspective. The MAR’23-MAY’23 spread is a negative 6 1/4 cents from $8.66 to $8.59 3/4 per bushel (down -$0.03 1/8 /bu/mo), & the MAY’23-JULY’23 spread is a negative 7 cents/bu (-$0.03 1/2 /bu/mo) – both of which provide a negative incentive for farmer storage of cash wheat from now into summer harvest in July 2023. Then, during the post-harvest period there is anticipation that the 2023 U.S. HRW Wheat market will move sideways-to-higher after Summer 2023 harvest lows into Fall & early Winter 2023, with the JULY’23-SEPT’23 spread being only a positive 1/2 cent/bu (+$0.00 1/4 /bu/mo). Similarly, the SEPT’23-DEC’23 spread is a positive 3 1/4 cents/bu into the end of the year (+$0.01083 /bu/mo) – representing a very small positive carrying charge during the post-harvest period.

- .

- CME Kansas Hard Red Winter (HRW) Wheat Futures Price Action since During 2022:

- At the start of 2022, the CME MAR’22 HRW Wheat lead contract closed the week ending on January 7th at $7.75 per bushel.

- Market prices rose into the week ending March 11, 2022, when MAY’23 HRW Wheat futures traded as high as $12.99 1/2 per bushel before closing at $10.89 1/4 per bushel. Prices rose again through the week ending on May 20, 2022, with CME JULY’22 HRW Wheat trading to a high of $13.79 1/4 per bushel, closing at $12.52 3/4 per bushel.

- Diminishing concerns about the impact of the Black Sea geopolitical situation on global wheat and food supplies, lead to weakening prices during the week ending July 22, 2022 – during which CME SEPT’22 HRW Wheat traded as low as $8.14 1/2 per bushel before closing at $8.20 1/4 per bushel. Another price low occurred during the week ending on August 19th, with CME SEPT’22 HRW Wheat trading as low as $8.08 1/2 per bushel, before closing at $8.47 per bushel.

- Following the July and August lows, wheat prices futures prices trended higher, with CME DEC’22 HRW Wheat futures trading as high as $10.37 1/2 /bu during the week of October 14th before closing that week at $9.52 1/4 per bushel

- Through mid-to-late December 2022, CME MAR’23 HRW Wheat traded as low as $8.21 3/4 per bushel for the week ending December 9th, while closing at $8.74 3/4 per bushel during the week ending December 23rd.

- This 12/23/2022 lead Kansas HRW Wheat futures closing price of $8.74 3/4 per bushel is up $0.99 3/4 per bushel from $7.75 for CME MAR’2022 HRW Wheat during the first week of January, 2022.

………

Following are the supportive working slides and notes for the Weekly Grain Market Review from Kansas State University (updated through market trades on Friday, December 22, 2022: